Get a quote

Learner Driver Insurance Explained

Apr 4 2022 1:51PM

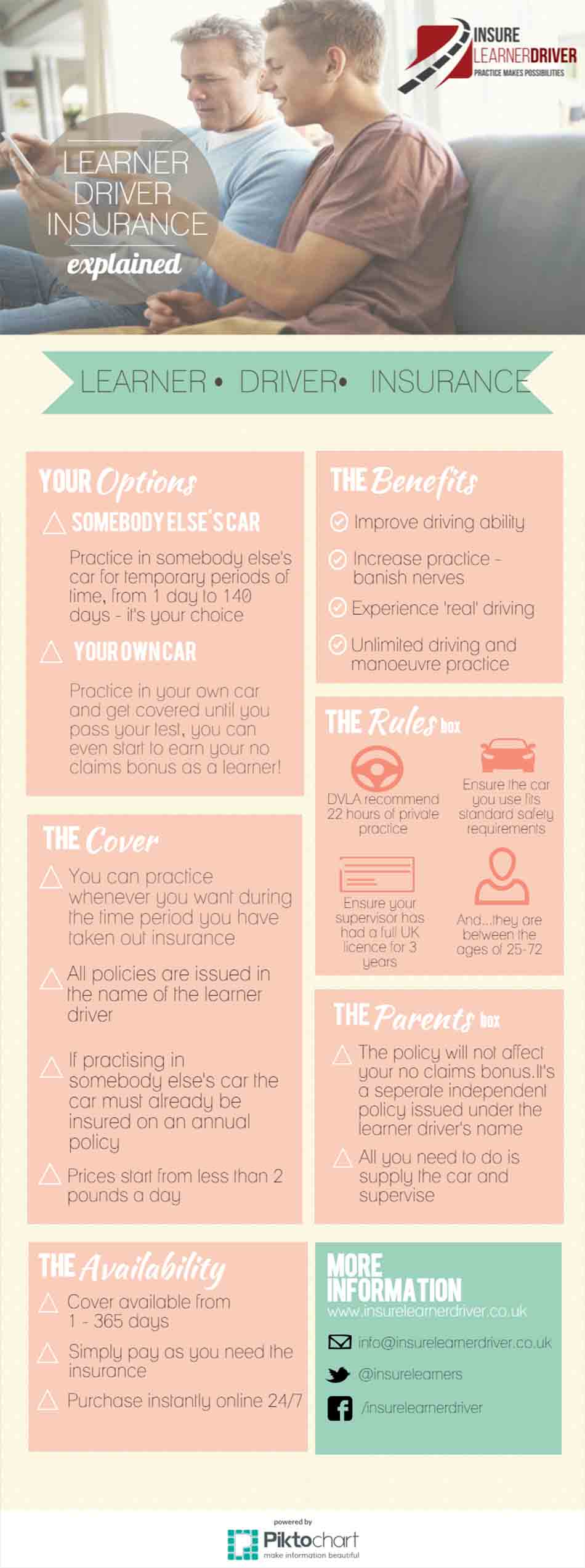

We understand learner driver insurance can be complicated, so we have simplified it in an Info-Graphic ...

What Have You Learned about Learner Driver Insurance?

Learner driver insurance comes with a variety of freeing options: How long you want your policy to last; who you want accompanying you in the car; when and where you want to practice. All of these things can be almost entirely determined by the policy holder. Hopefully the Info-Graphic above has better informed you about what cover is available to learners. However, just to clarify, here are the key points ...

- The car you're borrowing must have an annual policy.

- If you are borrowing a car, you are taking out a 'Top-Up' Policy. This means that if the learner has an accident the claim is made on their policy, not the car owner's annual policy. There's no need to worry about losing your no claims bonus.

- You must have an accompanying driver, you cannot drive on your own.

- Cover can be obtained instantly. InsureLearnerDriver has a 24 hour, online, quote system in place, where you can buy short term policies, to start within the same day up to 140 days.

Additionally, be aware that you can even use some learner driver policies on your driving test! (providing the vehicle meets all the standard safety and design requirements outlined by the DVLA).