Ways That Learner Driver Insurance Can Help You Pass Your Driving Test & Become a Safer Driver

Apr 1 2022 10:42AM

Learning to drive is the first step you take to your own freedom. It can be tough; but, it’s a huge achievement. Every learner driver’s goal is to pass the driving test and if they can, first time round. Learner driver insurance is an essential tool when it comes to passing your test and being safe on the road afterwards.

InsureLearnerDriver offers the chance to get learner driver insurance on a vehicle so you can practice privately. We offer insurance for learners who own their cars or want to be insured on someone else’s car.

Below we have explained how learner driver insurance can help you to pass your test and make you a safe as a full licence driver.

Use this navigation list to skip to the section about that you want to find out more about learner driver insurance :

Taking Out a Learner Driver Insurance Policy to Practice Privately

To drive a car in the UK, you need motor insurance. This protects the public if there is an accident and makes sure any claims are paid.

Insurance works by everyone paying into a central pot. When there is an accident, the insurer then pays the claims out of the pot. The more likely you are to make a claim, the more you pay into the pot.

Learner and new drivers are more likely to have an accident. So the insurance for young drivers usually costs more. Our provisional driver policies help learners gain experience. They give you time to practice outside of paid lessons with a Driving Instructor. . All you need is someone in the family or a friend to supervise you. If they have held a full driving licence for three years and match the rest of the policy’s acceptance criteria, you can practice as much as you want.

To practice as a learner driver, you legally need insurance. There are three levels of cover:

Third Party Only: The minimum level of cover required by law. Should you be involved in an accident, there is cover in place for a Third Party – Person or Property. However, there is no cover in place for accidental damage fire of theft for your own vehicle.

Third Party, Fire and Theft: This covers vehicles against fire and theft claims, although there is still no cover in place against accidental damage.

Comprehensive: Includes cover against any accidental damage on your own vehicles whilst still getting the same benefits as Third Party, Fire and Theft.

Always check your policy documents. They explain what is, and what isn’t covered.

Once you have the right insurance, you have the freedom to practice. All you legally need is a supervising driver who:

- over 21

- qualified to drive the type of vehicle the learner is practising in

- held a full UK, EEA or EU driving licence for 3 years

For our insurance policies, your supervising driver will need to be between 25 and 72. This is to make sure you are extra safe behind the wheel.

Private Practice Builds Your Driving Confidence

We carried out a survey in 2017 amongst young drivers. We found many young drivers didn’t feel ready to drive alone, one said:

Young drivers who have just passed are very likely to be involved in an accident. Sadly, in 2014 young drivers caused 22% of crashes where someone was killed or seriously injured. In the same year, young drivers only covered 5% of the total distance travelled on the UK roads.

The lack of driving experience of young drivers means that they’re more at risk on the road than other drivers. Limited supervision in lessons before the test can only take you so far.

Extra hours of practice can help you take that extra mile, allowing you practice time in various conditions. It creates extra confidence because:

- You can learn at your own pace. Rather than lessons where you only have a one or two-hour slot to cover as much as possible.

- You have the freedom to develop your driving by being able to practice various parts of driving skills that you need to improve on.

- You can drive in various road conditions (whilst supervised) during private practice, which would prepare you for not only the day of your test, but when you’re a legal driver.

- Using lessons and private practice means you can be shown the right way of doing something by your instructor and perfect it in your own time.

Private practice is extremely important when it comes to building up your confidence behind the wheel, because it prepares you for driving alone.

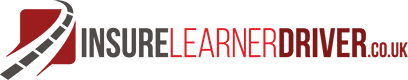

Of the learners we asked, 69% believed that private practice would help them pass their test sooner. 85% of the people we spoke to also felt that private practice increased confidence more than driving lessons.

Private Practice Will Save You Money on Learning to Drive

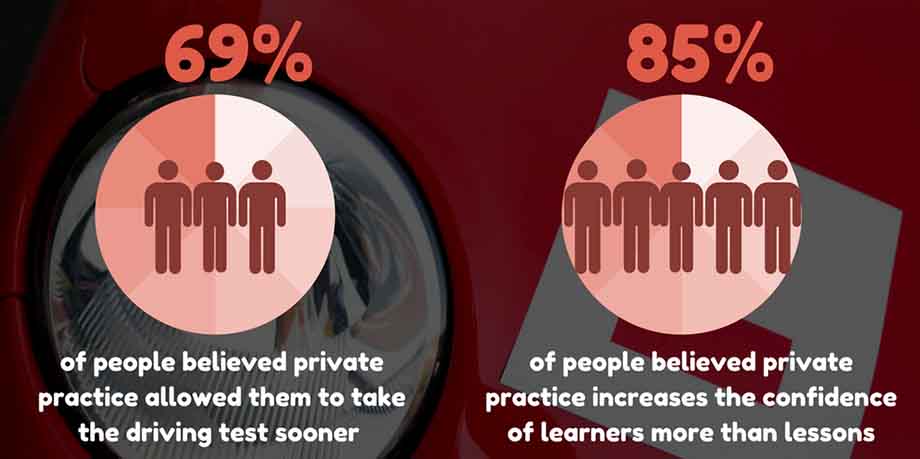

Over the past 9 years, RED Driving School stated that the number of 17-20 year olds taking the practical driving test has declined by 21% and 56% of new drivers have admitted that they had put off their test due to the cost of learning to drive.

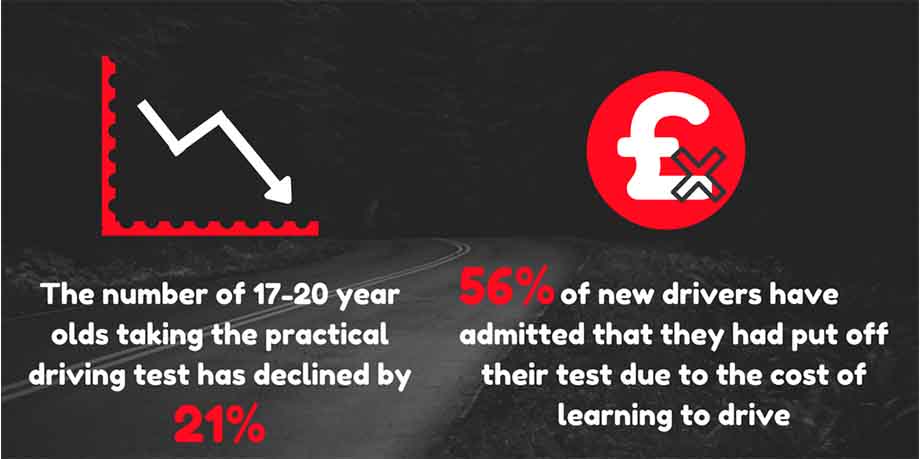

In our Young and Learner Driver survey, we found that 59% of learner drivers had to borrow money or sold their personal possessions to pay for driving lessons. In fact, we’ve broken down the costs for you:

By adding private practice, you can use lessons to learn new skills. Then you can practice in your own time. This means you won’t waste time in lessons perfecting that one thing you can’t quite get right.

There are several ways to get insured for private practice. Parents usually add a provisional licence holder to an existing insurance policy. However, this can be expensive and can affect the main driver’s insurance, including their No Claims Bonus.

By seeking out a company that specialises in learner driver insurance, the learner driver is under a separate independent policy. Any claims will be under the learner driver’s policy, not the owner of the car.

InsureLearnerDriver’s Policies

InsureLearnerdriver offers a wide range of policies for different situations at competitive rates.

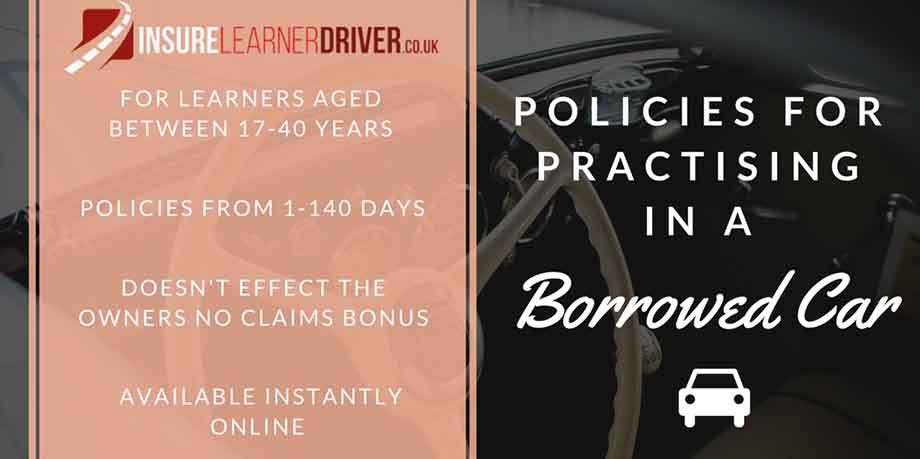

Short Term Cover for Learners Borrowing a Car

We offer short term policies for practising in a borrowed car, which ranges from 1-140 days.

We’re flexible when it comes to the length of cover. This is great if you want to:

- Get experience in your own time.

- Need an extra days practice in the run up to your driving test.

- Want to take advantage of a specific chance to practice.

- Need cover to take your driving test in a borrowed car.

- Not being able to afford the upfront cost of a full year’s policy.

Sometimes parents can be nervous about letting their children borrow their cars. This might be because their insurance will become very expensive or they are afraid of risking their No Claims Bonus. Our policies are separate from the main policy, which means any claims are kept separate.

Short Term Cover for Learner Drivers Who Own a Car

If you’re lucky enough to own your own car we can cover you as a learner driver.

It can be easier to go from a provisional to a full licenced driver when you’ve spent several hours practising in your own car. We offer short term policies for owners for anytime between 1 – 5 months. These short-term policies are also available online to purchases, so you can get driving on the same day.

Learner insurance for owners covers:

- Learners who want to have driving lessons in their own car

- They can practice any time the learner wants to during the insurance cover period

- Learners who wish to take their driving test in their own car

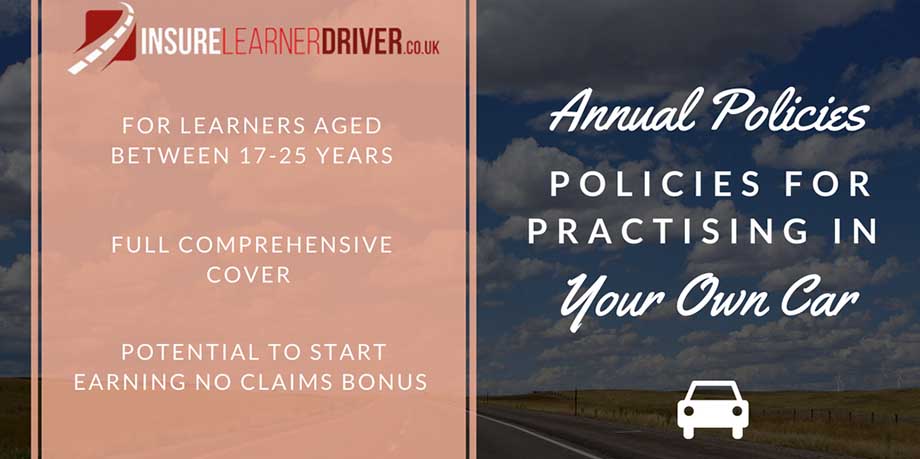

Annual Cover for Learner Owners

We also offer annual learner driver cover,which learner drivers can purchase for their own car. Once you have passed your driving test, we’ll then work with our new driver team to bring you onto a competitive full driver’s policy.

This can benefit learners because they can:

- start earning earning their ‘No Claims Bonus’ before they’ve passed your test

- get as much driving practice in addition to their driving lessons

- benefit from fully comprehensive cover

Additionally, upon passing their test, a simple call can be made to our Young Driver Team at Safely Insured who can change over your provisional cover to full licence cover in no time.

Once you’ve passed, we make it as simple and hassle free to change your cover to a full licence policy.

Car Insurance Cover for Your Driving Test

There are multiple benefits to taking the driving test in the car you’ve spent time practising in. The main one being that; if you are fully comfortable with the car, it should help with your confidence during the driving test.

The added experience you gain from conducting private practice can help with any nerves that come with taking your driving test.

The examiner is then classed as the accompanying driver under the policy. So you don’t need additional peo ple in the car.

If all goes well and you pass your test, you will no longer be a Provisional Licence holder. You’ll hold a full UK Driving Licence. This means your cover under this policy will end.

- If you purchased a policy with a cover period of 7 days or over, the Insurance Company of those policies also covers you ‘for up to 3 hours to drive directly home to your usual home address following your Driving Test’

- Policies with a cover period of 1-6 days do not include this, so end immediately when you pass your driving test

It is best to contact us before the test to make sure you’ll be covered.

Upgrading to a Young Driver’s Policy Once You’ve Passed Your Test

After passing your driving test, the first thing you’ll probably want to do is drive your car as a full licence driver. However, this part of the process be an intimidating one for many new drivers. This might be down to the price of insurance or just knowing if you’re doing it right.

The reason that car insurance for new drivers is more expensive than most, is because these are the drivers who are the highest at risk on the roads.

The road safety charity Brake found that one in four 18-24 year olds will crash within two years of passing their driving test. This means there is a higher chance of a claim.

Grouping all young drivers within this category may seem unfair, so there have been recent developments in Black Box and Telematics insurance policies which have given young drivers the opportunity to pay for personalised premiums.

A black box is a device, usually fitted in a car that monitors how the car is being driven. The insurer uses this information to assess driving and decide how much to charge. Drivers can also usually access the information and improve how they drive. The better the driving, the better the score, the more likely the price is to reduce.

A black box usually monitors your speed, braking levels, types of roads you use, acceleration levels, mileage and much more.

Many new drivers take out Black Box insurance so they can pay a price based on their driving.

In fact, industry statistics from the British Insurance Brokers Association (BIBA) show that there is a 40% drop in crash risk when a new driver has a Black Box or Telematics policy.

Safely Insured offers a range of policies for young drivers, including Black Box policies. They can offer competitive rates for InsureLearnerDriver customers. Additionally, Safely Insured has a dedicated team to help each driver that is insured with them to coach them to be better drivers.

Click here to find out more about Safely Insured policies for Young Drivers.

It’s a simple fact that the more practice you have, the easier it is to master a skill. So, when it comes to learning to drive, the more practice the better.

When you can practice privately, it offers a way to pass your driving test safely, quickly and cheaply.

For you to have the freedom to practice, you must have insurance. Our specialist options can be tailored to meet your needs.

To see how much it would cost to get a policy today, click on the button below.